Usluge:

Klijent:

We hope these guides help to provide some inspiration in taking the first step towards exploring using AI in your practice and encouraging your clients to do the same. So, to help you and your clients embrace AI and understand the benefits of these new tools, we’ve published two simple AI guides, tailored to small businesses and their advisors. Xero’s dashboard template provides you with insights about cash flow, bank accounts, sales and expenses entered in Xero to stay on top of your business. We were excited to unveil the first look at the client insights’ snapshot which shows key client financial health metrics such as business health, profit and expenses across the practice.

We take care of complex data integration by connecting to Xero platforms (Accounting, Practice Manager, WorkflowMax) as well as a variety of other solutions. When you need to customize this template (or any other dashboard) to include different metrics, add metrics from different sources, etc., you can do so by using Databox’s Dashboard Designer. The online accounting dashboard gives you the tools to proactively follow up on outstanding invoices.

Whether you are looking for client reporting dashboards, agency dashboards, marketing dashboards, or sales dashboards, Databox can help you build them. Xero Payroll in the UK also includes a number of improved features designed to suit a workforce that increasingly wants to work more flexibly. We’ve made it easy to manage employees’ working patterns to support non-traditional working hours, such as four-day working weeks. Set up of employee pensions has also been simplified with additional guidance and increased flexibility to edit and update fields. Tap to Pay will first be offered to UK Android users in a beta program in August, and available on more platforms in the following months. Connect to apps that integrate with Xero to manage operations and collaboration from a single place.

Get a clear, up-to-date picture of the money in your bank accounts, credit card and PayPal accounts. We believe this kind of thoughtful, purposeful innovation is what’s going to add the most value to you and your clients, now and in the future. This development followed our launch late last year of generated answers in Xero Central, our customer support and learning site, which has reduced search times by approximately 40%. We can’t wait for some of you and your clients to get a taste of JAX when it launches in beta in August. If you don’t use Xero, you can pull data from any of our 100+ one-click, native integrations or from spreadsheets, databases and other APIs. Select whether you’re a small business, or a partner, to find out how you can earn.

These guardrails ensure Xero customers using JAX for accounting tasks can trust its precision and accuracy. We think these guardrails will be really effective and will give us the ability to truly reimagine accounting for you and your clients. In the months ahead, you may notice that your Xero dashboard looks a little different.

Get a financial snapshot with our „Financial Overview Dashboard.“ Tailored for decision-makers, it offers real-time insights into revenue, expenses, and profitability. Small businesses, accountants and bookkeepers locally and across the world trust Xero with their numbers. Explore Xero accounting software and its tools for small businesses, accountants, and bookkeepers. We’ve had a really positive https://www.personal-accounting.org/simple-interest-calculator/ response from customers who have tested the new dashboard as part of our design research panel. We will continue to listen to your feedback on the features you’d like to see in the future, so we can make it easy for you to keep an eye on your finances and stay on top of your cash flow. Get a snapshot of cash coming in, going out, and bills that are due, to gain insights into business cash flow.

It will make managing jobs across your practice much easier when you know how they line up to your clients’ tax obligations. It will help you automatically prepare partnership annual accounts and tax using Xero data, and seamlessly file partnership tax returns with HMRC. You can now manage your compliance tasks, all in one place, eliminating the need to have multiple practice tools. Digitising tax and accounts workflows is the key to optimising efficiency in your practice, so we were delighted to unveil the next addition to Xero Tax, our new partnership tax solution, at Xerocon.

At Xerocon today, I also touched on some other exciting developments Xero has made in the GenAI space. We finalise the integration process by connecting your data with visually stunning Accounting Practice Dashboards that let you monitor and improve your business continuously. We analyse your needs, create insightful dashboards, teach you how to use them, and support you along the journey. The Designer allows you to easily drag-and-drop metrics and visualizations from any data source right into your dashboard. Let us know what you are trying to build and our team of experts will help you turn your data into actionable insights.

With so much data it is hard to understand what should be included on your Business Dashboards. We run data discoveries and proof of concepts with your data to ensure project scope, costs and timeframes are clearly defined from the outset. Dashboard Insights closes the gap between people and data, allowing you to run your business with more efficiency and intelligence so that you are making insightful decisions with confidence. We combine the best of visually stunning dashboards with real-time data.

Keep an eye on your finances day by day using the accounting dashboard. Soon, you’ll also be able to align your payroll leave period to their financial or operational periods. Our vision is to build the most insightful and trusted small business platform. And Xero is making a big investment in the UK as part of its business strategy. If you couldn’t make it to Xerocon, or just need a recap, here are a few of the key announcements about things that are now available or coming soon.

Lead with confidence using our „SaaS Leadership Dashboard“ powered by ChartMogul and Xero. We showcased the first look of payroll manager, a new dashboard in XPM and Xero HQ, that gives you prepaid insurance definition an easy way to view payroll data across your practice’s clients in one place. Client insights will provide accountants and bookkeepers with the data they need to best support their clients.

It’s all part of our work to upgrade the technology that underpins our platform, so it doesn’t slow us down over time. Just as you need to upgrade your phone every few years, we need to update Xero so we can continue to build the features that you need in your business or practice. I’m excited about the developments we’ve made in GenAI over the last year, and we’re just getting started. As GenAI continues to evolve, the possibilities it brings in terms of efficiency, innovation, and competitive advantage to businesses that embrace it are vast. At Xero, we’re really excited about the possibilities these new AI developments will open up for you and your clients, but adapting to new tools – even if they’ll make life easier – can be difficult or confusing.

Many of you have been eagerly watching to see how the rise of generative AI can help support productivity for you and your small business clients. And soon Just Ask Xero (JAX), our generative AI-powered smart business companion, will be here. It is available in beta in August and will help you and your clients run your business more efficiently. You’ll be able to ‘Just Ask Xero’ to complete tasks like generating an invoice or editing a quote, either in Xero or via other apps and devices that you regularly use day-to-day, such as mobile, WhatsApp and email.

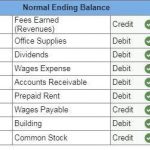

These new financial insights help you confidently grow your advisory offering by highlighting clients who would benefit from timely conversations about emerging issues. This proprietary technology helps JAX navigate accounting tasks with precision, by using a control system to ensure the data that’s fed to the LLMs is only related to the relevant task, such as creating an invoice. It also ensures the LLMs only receive data that you’ve given Xero permission to access, and keeps the data safely within the platform. Your https://www.quick-bookkeeping.net/ should include key metrics such as cash flow, outstanding invoices, bills to pay, and bank balances to ensure that you can always get a quick overview of your business finances.

It was so exciting to demonstrate Just Ask Xero (JAX) live in front of an enthusiastic crowd of accountants and bookkeepers at Xerocon London today. We previewed this innovative new product at our Investor Day earlier this year, and we’re really proud to be able to show a live demo only a few short months later. Explore all the different ways you can use Databox to gain better data insights needed to drive better business decisions. Discover our pre-built templates from various integrations that businesses use on a daily basis to improve performance. As you can see, we’re really making strides on delivering on our product vision to build the most powerful accounting platform in the UK.