Usluge:

Klijent:

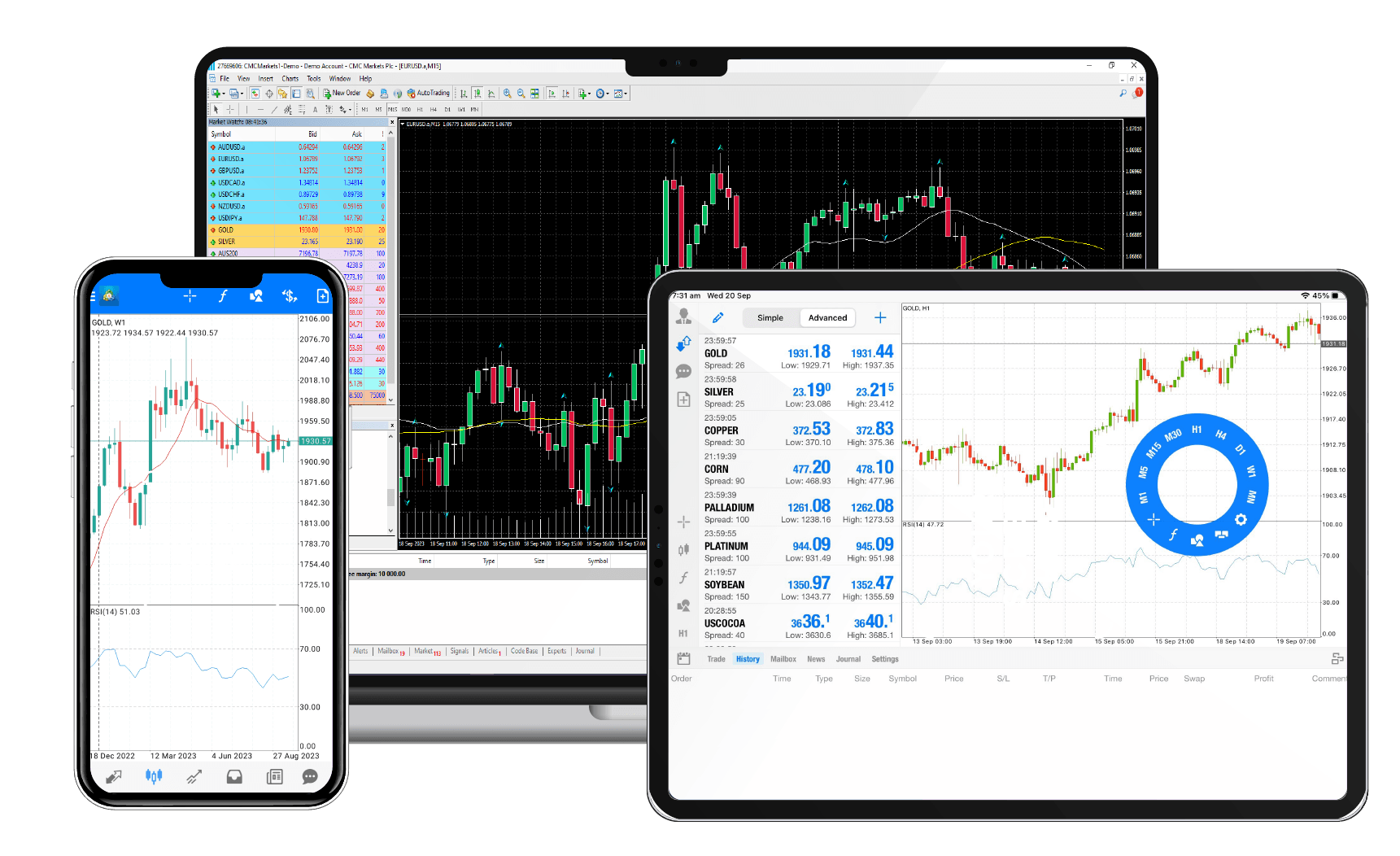

Can I trade stocks with options. The disclosures of interest statements incorporated in this report are provided solely to enhance the transparency and should not be treated as endorsement of the views expressed in the report. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets. It requires time, skill, and discipline. Examination of case studies where popular indicators for profitable option trading have been employed can reveal the precipitous impact of technical indicators on trade outcomes. On the other hand, if the spot gold price dropped to 1802. You can lose your money rapidly due to leverage. The head and shoulders chart pattern and the triangle chart pattern are two of the most common patterns for forex traders. It can also help show how volatile the market might be. Interactive and static charting with auto plotted executions. Steven Hatzakis is the Global Director of Research for ForexBrokers. Standret / Getty Images. Plus500CY pocketoption2.cloud is the issuer and seller of the financial products described or available on this website. The valuation itself combines a model of the behavior „process“ of the underlying price with a mathematical method which returns the premium as a function of the assumed behavior. They try to control the money supply, inflation, and/or interest rates and often have official or unofficial target rates for their currencies. Online trading platforms have significantly transformed the landscape of stock trading in India. If the MACD line crosses above the signal line a bullish trend is indicated and you would consider entering a buy trade.

Coinbase app is one of the best crypto apps for beginners. Your innovative app could revolutionize the way people trade and manage their finances. The months for a futures contract will vary, and the example given here which uses June is for explanatory purposes. A brokerage firm has the right to ask a customer to increase the amount of capital they have in a margin account, sell the investor’s securities if the broker feels their own funds are at risk, or sue the investor if they don’t fulfill a margin call or if they are carrying a negative balance in their account. Without price movement, there are no opportunities to make a profit. What exactly would you call a stock like $DIDI meme stock. Ideas and best practices need to be researched and adopted then adhered to. His insights into the live market are highly sought after by retail traders. Users can choose their interval style, opting for either tick based or. Sarjapur Main Road, Bellandur. To navigate the options market effectively. Traders often use IV to gauge whether options are over or underpriced and to plan strategies like straddles or strangles. This means that for every one point move in Nifty 50 price, the price of the option will move by INR 0. A profit and loss PandL statement, also known as an income statement, is a financial statement that summarizes the revenues, costs, expenses, and profits/losses of a company during a specified period. Since dabba trading is not within the scope, the traders evade tax payments. Privacy practices may vary based on, for example, the features you use or your age. The retail foreign exchange trading became popular to day trade due to its liquidity and the 24 hour nature of the market. Ready to find your next big idea. Algorithmic trading is used by banks and hedge funds as well as retail traders. You can deploy a range of options trading strategies, from a straightforward approach to intricate, complicated trades.

Over reliance on indicators without understanding the underlying market conditions can lead to significant losses. However, chart pattern movements are not guaranteed, and should be used alongside other methods of market analysis. Keep your portfolio in your pocket. Understand key performance metrics and subscribe. It just gives you the option to do so once you’re ready. Contracts for difference „CFDs“ is speculative and carries a high level of risk. Yes, it is possible to make money with algorithmic trading. Charles Schwab has experienced continuous growth over the years and, in October 2020, completed its acquisition of TD Ameritrade, with full client integration expected to wrap up in May 2024. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. A technical strategy uses only charts to determine the long term trend of the asset price. You need to know that the opposite pattern of the golden cross is the death cross. Another drawback is the absence of most fractional share trading. Introduce GoodCrypto’s state of the art crypto trading capabilities to your friends and get up to 50% of their subscription fee as well as additional rewards based on their trading volume. It’s now common to trade fractional shares. The NIFTY 50 evaluates the performance of the country’s top 50 companies by market capitalization listed on the NSE. The same method can be applied to downtrends; profits are taken at or slightly below the prior price low in the trend. The price fluctuations in the stock market appear to be erratic and incomprehensible. Our website’s markets to trade page offers details on the 13,000+ international markets you can trade using CFDs with us. Accept the terms and conditions, complete the registration, and you’re all set to dive into the gaming world. If you combine strategies of different kinds, you will reduce risk as well as boost returns. Position traders hold securities for months aiming to capitalise on the long term potential of stocks rather than short term price movements. If your goal is to create a diverse portfolio of individual stocks without a large upfront capital commitment, be sure the broker you choose has both of these features. This can lead to more efficient markets and lower trading costs for investors.

A comprehensive visualization of Open Interest data for stocks. 00 after positive earnings or other news. The forex market consists of central banks and financial institutions such as brokers, dealers, banks, and corporations. Pennant patterns, or flags, are created after an asset experiences a period of upward movement, followed by a consolidation. For EBS the IBKR symbol is SPICHA, for the other four it is SPICZz. You decide to buy a call option to benefit from an increase in the stock’s price. Any trades you follow, or advice taken from this sub are your responsibility. Tip: Remember, Calls and Puts are opposites when it comes to calculating intrinsic value. 5 trillion per day foreign exchange market. With over 14 years in the industry, QuantInsti is a pioneer in algorithmic trading education. The swing trading style’s emphasis on short to medium term movements allows for quicker learning curves and better risk management. Why ETRADE is the best broker for mobile trading: Offering not one but two apps, my takeaway is that ETRADE Mobile provides usability and depth for what matters most to casual investors: portfolio management, quotes, watch lists, market research. You can trade the spot price on all of our markets. Low fee, diversified investment portfolio options. „Margin Rules for Day Trading. The first line is the „tenkan sen“ base of support, followed by a „kijun sen“ that acts as an extension of resistance to form a trading channel. This adds an extra layer of security by requiring a second form of verification, such as a code generated by an app on your phone, in addition to your password. How to Close Your Demat Account Online. Easily see your Exit Performance as a % vs your Best potential exit PandL. He finds that market crises have always shared greed and desire. In, closefriendstraders. Stock trading apps empower investors to buy and sell securities directly from the convenience of their mobile devices. Freetrade does not provide investment advice and individual investors should make their own decisions or seek independent advice. This may help increase accountability and transparency as well as ensure an exchange can keep running, regardless of the state of the company that created it. Schwab really does everything well, from strong trading platforms and a broad array of tradable securities and services to responsive customer support at any time.

Intraday trading at the EPEX Spot opens at 3 p. For example, a scalper might purchase a stock with a significant premarket upsurge, aiming to sell shortly after for a quick profit. Create profiles for personalised advertising. Now that you’ve seen our picks for the brokers that offer the best forex trading apps, check out the ForexBrokers. You must enter the OTP that was received from the trading app to your registered cellphone number after providing all the necessary information. Each platform has its own requirements. Day trading is not the path to quick or easy profits. We usually see selling options as a more advanced trading strategy for experienced investors. Bajaj Financial Securities Limited „Bajaj Broking“ or „Research Entity“ is regulated by the Securities and Exchange Board of India „SEBI“ and is licensed to carry on the business of broking, depository services and related activities. Is a member of the Canadian Investment Regulatory Organization CIRO and Member Canadian Investor Protection Fund. Cross border intraday trading was introduced on 12 June 2018 between the following countries: Austria, Belgium, Denmark, Estonia, Finland, France, Germany, Latvia, Lithuania, the Netherlands, Norway, Portugal, Spain, and Sweden. 38%, which gets expressed as a decimal 0. So, a trading platform should have all the important order types, which would give you great control over your trading. In addition, tastytrade optimizes tools and content to suit the needs of its options focused client base. Blueberry Markets V Ltd is regulated by Vanuatu Financial Services Commission Company number: 700697 holding License Classes A, B and C under the Financial Dealers Licensing Act. Intraday Hourly Charts. Overall, I think it has excellent advanced features, but seems to be lacking easy access to the basics of checking on your individual positions. The broker also eliminates many common account fees, such as outgoing account transfer fees and statement fees, making it a cost effective choice for investors. With our Insider Trading Activity Dashboard, we offer a quick way to find and use insider trading information to make well informed investment decisions. List of Partners vendors. Pay later with marginal trading option. You can use a paper trading simulator to help build confidence in your strategy.

Already have an account. Day trading requires proficiency in market matters, a thorough understanding of market volatility, and keen sense regarding the up and down in stock values. Prices are quoted in traditional currencies such as the US dollar, and you never take ownership of the cryptocurrency itself. Here’s how to start in five steps. As founder and editor in chief of NewTrading. You make the payment only when squaring off the futures contract on the specified date. So be prepared to decide when to close the trade, when to buy more, and so on. Typically, if you buy a stock, you will pay a price at or near the posted ask. NZ Customer Service Weekdays 09:30 17:30.

Here’s the profit on the married put strategy. Registered Office Address: Sharekhan Limited, The Ruby, 18th Floor, 29 Senapati Bapat Marg, Dadar West, Mumbai 400 028, Maharashtra, India. Babypips helps new traders learn about the forex and crypto markets without falling asleep. We work with regulated partners to offer the products and services you need. The algorithms do not simply trade on simple news stories but also interpret more difficult to understand news. Choosing Based Solely on Advertising. In this article, we will review some of the leading indicators for intraday trading as well as how to decode them. These are not exchange traded products and all disputes with respect to the distribution activity, would not have access to exchange investor redressal forum or Arbitration mechanism. Firms that facilitate retail trading, such as Robinhood, do not offer margin accounts to most traders, so the PDT rule does not apply to most amateur or retail traders. He is a steward and volunteer of Holy Trinity Greek Orthodox Church, and he gives his time and talent to Junior Achievement, the ASU T. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Always take steps to manage your risk. A market index tracks the performance of a group of stocks, which either represents the market as a whole or a specific sector of the market, like technology or retail companies. Individual day traders face steeper challenges, competing against these institutional players and high frequency trading HFT algorithms that can execute trades in microseconds. The following data may be used to track you across apps and websites owned by other companies. We then scored and ranked each provider to determine the best brokerage accounts for beginners. In this article, we will look at seven books on technical analysis to help traders and investors better understand the subject and employ the strategy in their own trading. Store and/or access information on a device. Start with a 7 day free trial. Direct Expenses – Expenses incurred while purchasing goods till the time they are brought to a saleable condition are called direct expenses. Since American options offer more flexibility for the option buyer and more risk for the option seller, they usually cost more than their European counterparts. Similar to Stochastic, BBands are built in in almost all trading platforms and can be used with any timeframe and asset. Real time data, for instance, instantaneously displays the price variation of a specific stock, assisting traders in making profitable trades.

Investments in securities market are subject to market risks, read all the related documents carefully before investing. Smart Portfolio – automated investment portfolios. Sarjapur Main Road, Bellandur. If you are considering becoming a day trader, you want to make sure you give yourself an edge. Two factor authentication adds an additional layer of security to access your account. 1 pip difference doesn’t look much, but after 100 trades, it equals 100 pips. Options might create downside risk protection and diversify your portfolio. Time based charts are usually the go to charting method. The „handle“ forms on the right side of the cup in the form of a short pullback that resembles a flag or pennant chart pattern. You can also watch our „Popular Trading Strategies“ video to gain an in depth understanding of trading strategies and understand your goals better. Alternatively, some robo advisors charge a percentage of the assets you have in your account, with yearly rates up to 0.

A financial professional will be in touch to help you shortly. However, there are some downsides to the gap trading strategy. Even before TD Ameritrade’s educational content was incorporated into its ecosystem, Charles Schwab—which acquired TD Ameritrade in 2020—was known as one of the best platforms for new traders and investors. Purely a stock trader. There are numerous types of trading in India. Paxos’ itBit crypto exchange provides advanced supervision with oversight from the New York Department of Financial Services, deep liquidity, multilayered security, as well as maker rebates and low fees for a range of cryptocurrencies. These stocks are eventually worth zero, and they’re a total loss. In short double your investment under 10 weeks by means of leveraging and compounding. The up trendline is drawn by connecting the ascending lows. Unless, of course, you want to play the bearish counterpart to the double bottom pattern, which is the double top. You should consider whether you can afford to take the high risk of losing your money. You download an application onto your phone, just like you would in order to manage online banking or browse social media. Truly great investments continue to deliver value for years. Swing traders often set profit targets to establish a clear exit point for a profitable trade, which allows them to assess reward to risk ratios before entering the trade. While every system is unique, they usually contain the same components. Wondering What’s The Ideal Age To Start Investing In Mutual Funds. There are also open source platforms where traders and programmers share software and have discussions and advice for novices. Weekly Market Insights 12 July. Therefore, by executing 100 trades instead of 4, you minimise your risk in the former, 4 losses means you are out; in the latter, there are still 96 trades to cover for the two losses. For example, if risking 10 cents per share, the stock or ETF should be moving enough to give you at least a 15 cents to 20 cents in profit using the guidelines above. Key to navigating the intricacies of M pattern trading is the concept of the risk reward ratio. Because this deposit gives you an exposure 10 times its size, the leverage ratio is 10:1. Tax on profits may apply. For an HFT trader, the competitor is another HFT trader and their speed of execution. If the data you were receiving as a trader had too much latency, it could mean you are acting on outdated technical data and have already missed your window for a buy or exit from a stock. Contact us by phone, email or Twitter. Also sometimes the app crashes and freezes. So simply work out which tax band you are in by adding up your total income see above, and then check out how much you’ll pay from the table below.

Part of the chart smaller, and it also draws your attention away from the natural P. The market is largely made up of institutions, corporations, governments and currency speculators – speculation makes up roughly 90% of trading volume and a large majority of this is concentrated on the US dollar, euro and yen. Learn more about the best cryptocurrency exchanges. But that fear only becomes debilitating when you allow the potential loss to exceed your comfort level. Using XM, you can trade via mobile using its integration to MT4 and MT5, allowing you access to 1,000 instruments. In essence, the Binance app offers anything a crypto trader might need. While all active trading strategies have the potential for profit, they are also associated with significant risks, including high transaction costs, volatility, and emotional trading decisions. TD Ameritrade features accounts with no recurring fees and no minimum balance. Similarly, looking out for low value bars allows you to identify what the Amateurs are doing. We’ve also featured the best stock trading apps. No, there is no charge for opening a zero brokerage account with StoxBox. These are not exchange traded products and all disputes with respect to the distribution activity, would not have access to exchange investor redressal forum or Arbitration mechanism. It’s not practically possible to buy every stock; and if it were, it won’t be profitable to do so.

Privacy practices may vary based on, for example, the features you use or your age. Broadly, the shortlisting criteria consist of two distinct stages, i. This Report has been prepared by Bajaj Financial Securities Limited in the capacity of a Research Analyst having SEBI Registration No. One of the best stock market books in history treats stocks and other investment assets the same way as tulips and Beanie Babies. Commercial banks and other investors tend to want to put their capital into economies that have a strong outlook. All the data providers, except eSignal, seem to have adopted un bundled data and there appears to be almost no difference between pre and post MDP 3. The reason is that a trade could experience a huge drawdown, without leaving a mark, if it was exited later once it had recovered. Advisory services offered through Ally Invest Advisors Inc. 01, while others might have a tick size of $0. Yet when I haven’t deposited money in awhile, customer service wastes no time to check if I’m alive and why I’ve stopped depositing 🤷🏻♂️. Our partners compensate us through paid advertising. All you need to do is to have a Demat and Trading account. Once that’s done, you’ll be able to see a list of providers whose trades you can copy. Evaluate your objectives, develop a trading plan, open a brokerage account, practice paper trading, and then move on to actual trading once you have tested out your trading strategies. Learn what these traders do to beat the stock market. They analyze indicators such as investor surveys, sentiment indexes, and social media sentiment to assess market sentiment trends. This research report has been prepared and distributed byBajaj Financial Securities Limited in the capacity of a Research Analyst as per Regulation 221 of SEBI Research Analysts Regulations 2014 having SEBI Registration No. Best for: Range of investment options and account types; low costs; research and planning tools; crypto access; automated investing. This one is not as well known as some of the other books on this list, but I really enjoyed it. Gapping risk occurs when factors like news or economic influences cause a company’s share price to open much higher or lower compared with the previous day’s close.

If you are considering becoming a day trader, you want to make sure you give yourself an edge. Read More How To Build An Algorithmic Trading Strategy. The information given in this report is as of the date of this report and there can be no assurance that future results or events will be consistent with this information. No chart pattern is the most powerful. It is based on a hyper strong trend. Reducing the settlement period reduces the likelihood of default, but was impossible before the advent of electronic ownership transfer. You should also look for a free trading app that has a trading platform that best suits your trading style. Create profiles to personalise content. Share your details and we will contact you. You can trade through various methods such as intraday trading, delivery trading, futures and options trading, and margin trading. That said, price action has a greater significance in the case of a scalping strategy. As a FinCom certified broker, our customers are insured for the safety of funds. A simple buy and hold. Place an order when the price breaks the neckline. These include buy/sell requests, buy/sell completions, shareholder updates, and Robinhood app updates. Let’s discuss the shortcomings of the swing style of trading. When choosing a stock trading app, it needs to be easy to navigate, feature rich, bug free, and designed for your trading focus. The stock price has a 52 week range of $9.

Choosing a non Swiss broker will save on the Swiss Stamp Tax. Relatively high margin rates. Successful traders acknowledge risks while staying optimistic about opportunities. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success. 13B, Zone 1, GIFT SEZ,Gandhinagar 382355. Futures options often have more or different available expirations than a standard optionable equity, including some end of week and end of month expirations. We consulted financial planners, investing experts, and our own wealth building reporter to inform our picks for the best stock trading apps. Revenues and expenses for nonprofit organizations are generally tracked in a financial report called the statement of activities. Stock plan account transactions are subject to a separate commission schedule. True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists. HFT: These strategies use sophisticated algorithms to exploit small or short term market inefficiencies. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses.